63 moons – The success story called ‘innovation in the fin-tech arena’

63 moons technologies has been extremely instrumental in transforming the landscape of various market segments and building global size and significance. Most of the market infrastructure that was created was in Greenfield ventures with 63 moons technologies’ vision making each of these ventures into markets of national importance.

63 moons’ brokerage trading solution suite – ODIN – became the top trading technology in Indian securities markets, and MCX became 3rd largest commodities derivatives exchange in the world.

United Nations Conference on Trade and Development (UNCTAD) described the contributions of MCX as one that catalysed development of the wider economic ecosystem, improved the flow of information, facilitated physical infrastructure development, and established reliable quality standards.

63 moons technologies has also set up high-tech exchange institutions in leading international financial centres, making India the first exchange industry MNC, in such important countries such as United Arab Emirates (UAE), Mauritius, Singapore, Bahrain and Botswana.

63 moons technologies is the only private sector company in joint venture with the Government of UAE at the time of setting up of the Dubai Gold and Commodities Exchange (DGCX), which now enjoys premier position as a leading commodities exchange in the Gulf.

The Group operated exchanges in 10 regulatory regimes across the regions of Asia, Africa and the Middle East.

Extensive ecosystem of institutions to support the financial markets in the form of separate subsidiaries for warehouse and collateral management, real-time information, mobile payment systems, which are all vital for the sustained growth of domestic financial markets.

Recent Posts

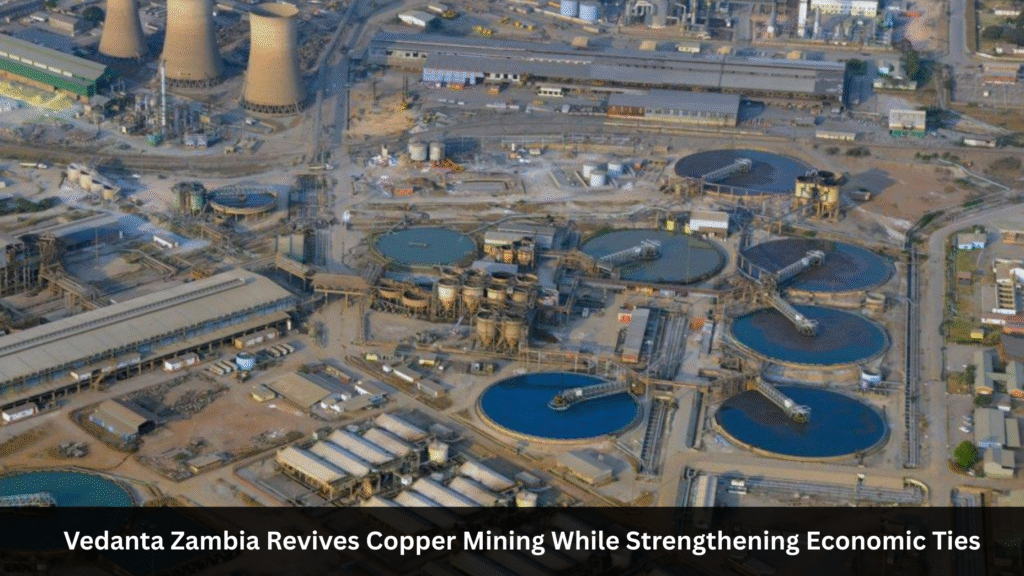

- Vedanta Zambia Revives Copper Mining While Strengthening Economic Ties

- Essar Merino Laminates Teams up with Green Line to Achieve Sustainability in the Laminate Sector

- Hire Bspoqe Associates for Indian Style Small Modular Kitchen Design

- Empowering Financial Success: Jamie McIntyre’s Contributions to Bali

- 24/7 Support for Premature Babies and New Mothers in Delhi NCR

Recent Comments

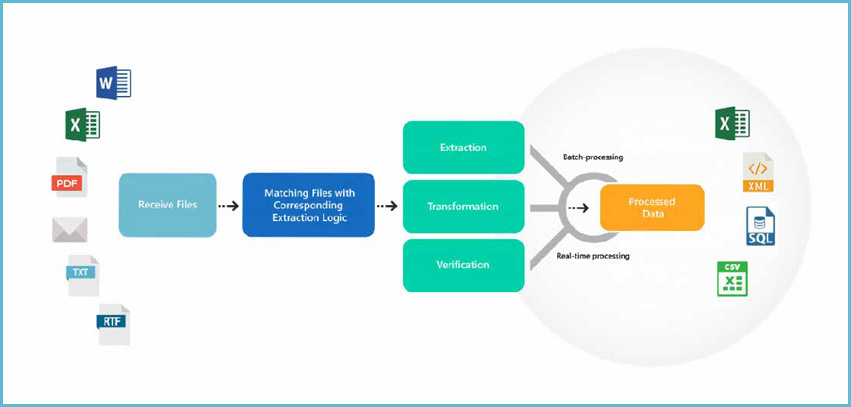

How You Can Bring Accuracy and Security When You Outsource Data Extraction Services

63 moons - The success story called ‘innovation in the fin-tech arena’

Indian Automotive Industry Embraces Electric Vehicles for a Sustainable Future

6 Simple & Effective Ways to Nurture Your Customer Relationships

Vedanta Zambia Revives Copper Mining While Strengthening Economic Ties

Essar Merino Laminates Teams up with Green Line to Achieve Sustainability in the Laminate Sector

Hire Bspoqe Associates for Indian Style Small Modular Kitchen Design