Being a student is both an exciting and challenging time in one’s life. It is a time for personal development, education, and adventure but also a time when money is tight. Tuition, textbooks, housing, and other everyday expenditures can quickly mount up, leaving many students needing help to make ends meet.

However, with careful planning and clever tactics, you may get through your student years without bankruptcy. This essay will look at some helpful money-saving methods for students and will teach you how you can save money while applying for documents like proof of a round-trip flight ticket.

Make A Budget

Creating a budget is the foundation of managing your funds as a student. Begin by outlining all of your sources of income, including scholarships, part-time work, and financial aid. Then, break down your monthly spending into rent, groceries, transportation, and entertainment categories. Make sure that your expenses are within your revenue. There are numerous budgeting applications available to assist you in keeping track of your finances and staying on top of your spending.

Reduce Textbook Costs

Textbooks can be an expensive purchase for students. To save money, do the following:

- Buy Used or Digital: Used textbooks or digital versions are often less expensive than new printed copies.

- Rent Textbooks: Some websites allow you to rent textbooks for a semester, saving you much money.

- Use the Library: Borrow textbooks from your university’s library whenever possible.

Home Cooking

Eating out frequently might drain your bank account faster than you would imagine. Cook your meals at home instead. Plan your meals, shop in bulk, and learn basic cooking skills. It is not only less expensive, but it is also a healthier option.

Make Use Of Student Discounts

Take advantage of any student discounts you can find. Many retailers, restaurants, and even transportation agencies provide student discounts. Carry your student ID with you always and ask about discounts whenever possible.

Investigate Your Housing Options

Housing is sometimes one of the most expensive expenses for students. Consider the following alternatives:

- On-Campus accommodation: If available, on-campus accommodation may be less expensive than off-campus living options.

- Roommates: Sharing a house or apartment with roommates can help you save money on rent and utilities.

- Consider Commuting: Commuting from home may be a more cost-effective option if you live near college.

Reduce Unnecessary Expenses

Determine where you can reduce your expenses. Reduce coffee shop trips, restrict impulse purchases, and cancel unused subscriptions. Also, it is better if you consider taking public transportation or carpooling. If you live off-campus, consider taking public transit or carpooling to save money on gas and parking. Many institutions provide students with cheap or even free transportation.

One other tip for students is to investigate scholarships and grants. Keep an eye out for scholarships and grants for which you are eligible. These can assist in offsetting your tuition fees and reducing your total financial burden.

Work On The Side

Consider working part-time, either on or off school, to boost your income. Just don’t overcommit and jeopardise your academic performance. Credit cards are a two-edged sword. While they might provide financial flexibility, they can also lead to debt if misused. Pay your credit card debt monthly to prevent high-interest costs.

Being a student does not have to imply living on a shoestring or worrying about money all the time. By applying these money-saving measures, you may better manage your finances, minimise stress, and focus on your studies. Remember that financial discipline is a critical skill that will serve you well once you graduate from college.

So, budget, minimise unnecessary costs, look for discounts and affordable accommodation, and always look for ways to save. You may enjoy your student life without going broke with a little strategy and determination.

Important Note

If you struggle at finding an answer to how to get schengen visa insurance? We recommend that you consult a representative from the embassy or a travel agent. Keep yourself safe from any scam.

Recent Posts

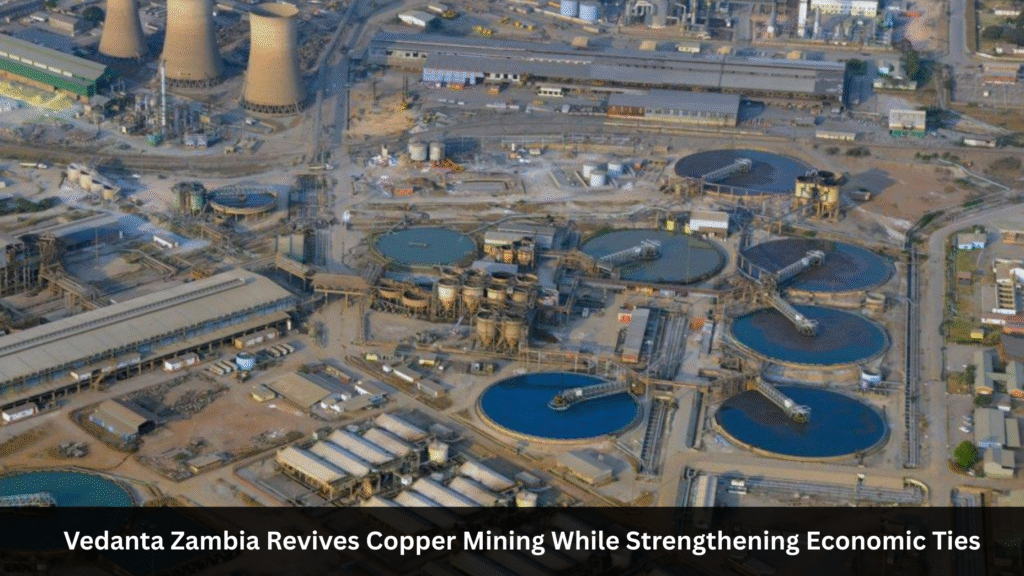

- Vedanta Zambia Revives Copper Mining While Strengthening Economic Ties

- Essar Merino Laminates Teams up with Green Line to Achieve Sustainability in the Laminate Sector

- Hire Bspoqe Associates for Indian Style Small Modular Kitchen Design

- Empowering Financial Success: Jamie McIntyre’s Contributions to Bali

- 24/7 Support for Premature Babies and New Mothers in Delhi NCR

Recent Comments

Navigating Delaware's Best Deals: Used Tire Shops Unveiled

Best Way To Visit Shimla Manali With A Tour Package

Best Time to Visit Srinagar Tulip Gardens

Which Schengen Visa Is Easy To Get

Vedanta Zambia Revives Copper Mining While Strengthening Economic Ties

Essar Merino Laminates Teams up with Green Line to Achieve Sustainability in the Laminate Sector

Hire Bspoqe Associates for Indian Style Small Modular Kitchen Design