The value of LIC’s investments in Adani Group equities has increased by 59%

The Adani Group and LIC (Life Insurance Corporation of India), two of the nation’s biggest conglomerates, partnered in a move to accelerate the development of India’s infrastructure. It is anticipated that the Adani LIC partnership will make large sums of money available for vital infrastructure projects in industries like logistics, transportation, and energy. This enhances the Adani Group’s capacity to carry out large-scale projects and provides LIC with competitive returns on its investments, which eventually increases policyholder wealth. Seen as mutually beneficial, the alliance might hasten India’s economic expansion and infrastructural development.

LIC is a state-owned insurance giant. Post the conglomerate staged a swift comeback after being hit by a damaging short seller report, the value of LIC’s investments in Adani group firms increased by 59% in the 2023-24 fiscal year. Stock market data shows that LIC’s stake in seven Adani group firms has increased in value by 22,378 crore, from Rs 38,471 crore as of March 31, 2023 to Rs 61,210 crore as of March 31, 2024.

The insurance behemoth was under heavy political scrutiny last year for its investment in the Adani group, which was sparked by claims of stock manipulation stoked by the Hindenburg report. The stock price of Adani Group, which fell by almost USD 150 billion at its lowest point, has recovered spectacularly thanks to strong profit growth in all of the company’s operations.

Unravelling the Impact of LIC’s Strategic Investment Moves

Adani Ports & SEZ and Adani Enterprises, two of the Group’s main enterprises, saw their shares spike by 83% and 68.4%, respectively, after LIC deliberately cut its exposure to them in response to political pressure. Despite the company reducing its shareholding, stock market data shows that LIC investments increased in value by 59% in FY24. This shows the positive outcomes of Adani LIC alliance. Among the most significant increases, the value of LIC’s investment in Adani Green Energy Ltd. more than quadrupled to Rs 3,937.62 crore in only one year.

Even while the local investor was under pressure, international powerhouses such as the Qatar Investment Authority, Abu Dhabi-based IHC, French behemoth TotalEnergies, and US-based GQG Investment poured about 45,000 crore rupees into Adani shares. LIC’s investment in Adani Enterprise Ltd. increased in value from 8,495.31 crore rupees as of March 31, 2023, to 14,305.53 crore rupees a year later. As of March 31, 2024, its investment in Adani Ports and SEZ increased from Rs 12,450.09 crore to Rs 22,776.89 crore.

The insurance company’s holdings in ACC, Adani Total Gas Ltd., and Ambuja Cements all increased in value. Since the release of the Hindenburg report a year ago, Adani has solidified its position as the top infrastructure conglomerate in India. The company is dedicated to driving the country’s shift to green energy and has a strong presence in important areas including highways, ports, airports, and data centres.

The Expanded Role of LIC in Adani Group Stocks

The investing community is quite interested in the recent increase in LIC’s holdings of Adani Group shares. A major participant in India’s business scene, the Adani Group has varied holdings in cement, energy, logistics, and infrastructure. With its increased investment in Adani, LIC has shown its faith in the conglomerate’s strategy, business model, and expansion prospects in a number of industries.

The confidence that LIC has in the future of the conglomerate Adani Group is evident from the 59% appreciation in the value of the company’s equity holdings in the business. The investing strategy of LIC is congruent with Adani Group’s, which aims to provide better returns for policyholders over the long term, thanks to the company’s history of wealth creation, emphasis on sustainability, and development into new areas.

Implications and Market Dynamics

The large-scale investments made possible by Adani LIC alliance have far-reaching consequences for the company and the financial market as a whole:

- The additional investments made by LIC show that the insurance company has faith in Adani Group’s future success and strengthen investor attitude towards the conglomerate. More retail and institutional investors may feel confident enough to put money into Adani Group as a result of this vote of confidence.

- Adani Group’s strategic ambitions, operational efficiency, and financial resilience have been validated by the spike in LIC’s investments, which is a positive sign for the company. It further solidifies the conglomerate’s status as an attractive investment option, which might pave the way for future efforts to diversify and expand.

- Other institutional investors and fund managers often use LIC’s investment choices as benchmarks. Investors may revaluate their investing strategy in light of the large growth in LIC’s holdings in Adani Group stocks and think about adding the conglomerate to their portfolios.

- While LIC’s increased holdings in Adani Group shares show optimism about the company’s future, they also highlight the significance of risk management and a diversified portfolio. The investment committee at LIC is always looking for ways to improve policyholders’ risk-adjusted returns and reduce concentration risk in the portfolio.

Conclusion

The increasing number of investments in Adani Group stocks by LIC is a noteworthy change in India’s financial scene, highlighting the rising profile and attractiveness of the conglomerate to investors. Adani Group’s strategic allocation to LIC aims to provide sustainable growth and shareholder value, as LIC navigates changing market dynamics and seeks investment opportunities that enhance value. Thanks to LIC’s support, Adani Group is ready to take the next step in its development story, establishing itself as a major participant in India’s business world.

Recent Posts

- Yüzde 100 Ücretsiz Harbors Down Load Yok Tamamen Ücretsiz Video Yuvası Keyfini Çıkarın

- Die besten Casino-Spiele für strategische Spieler Ihr Leitfaden zum Gewinnen Beste Casinos Schweiz

- Die Geschichte der Spielautomaten

- Beliebteste Casino-Spiele in Deutschland Favoriten im Überblick

- Casino Bonus Kalender alle Boni auf einen Blick

Recent Comments

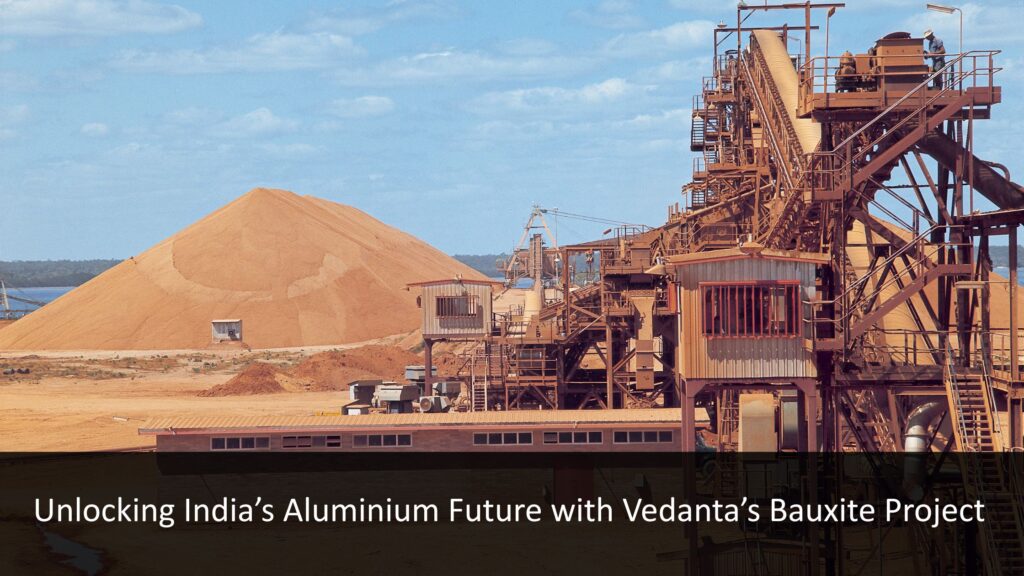

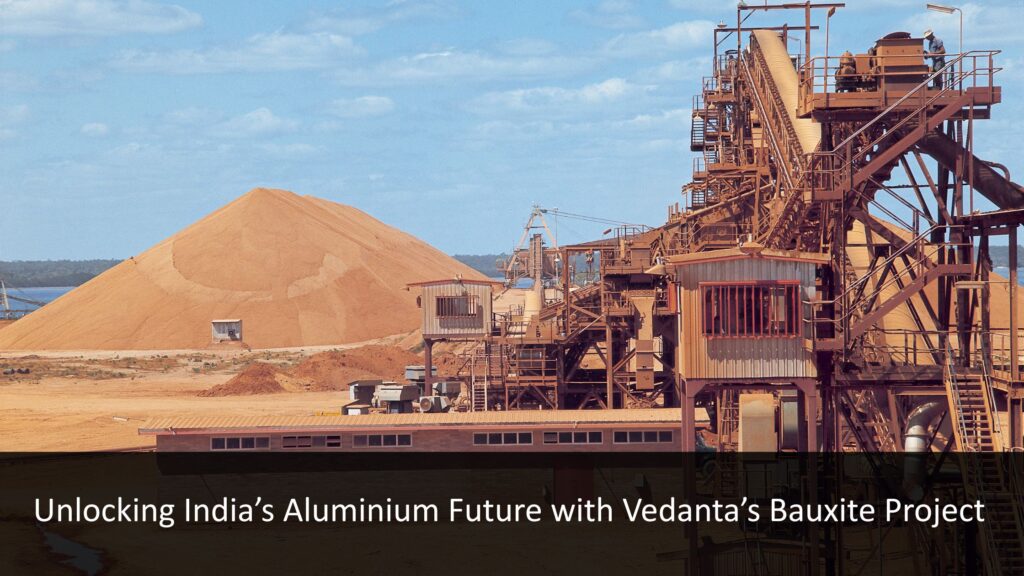

Unlocking India’s Aluminium Future with Vedanta’s Bauxite Project

Tjori Builds and Retains Customers' Trust through Best Practices

How Adani’s Rs 2000 Crore Commitment is Reshaping India’s Employment Landscape?

Why Choose the Best Email Marketing Agency USA?

Unlocking India’s Aluminium Future with Vedanta’s Bauxite Project

Tjori Builds and Retains Customers' Trust through Best Practices

How Adani’s Rs 2000 Crore Commitment is Reshaping India’s Employment Landscape?